|

A state income tax for Washington? By ROBERT MAK / KING 5 News and Associated Press 12/3/02

For the past year, Bill Gates Sr. has been leading a committee studying the Washington state tax system, and Tuesday morning, the committee released its report. At the top of the list: a recommendation to make some big changes to the tax system.

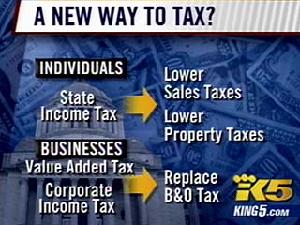

KING "Higher-income people tend to save more of their money, they also tend to spend more of their money out-of-state, and more of their money on services, said Rep. Jim McIntire, D-Seattle. Poor people pay as much as 16 percent of their income in sales taxes, Gates said, while the rich pay as little as 4 percent. Meanwhile, Washingtonians miss out on the opportunity to deduct state income taxes from their federal tax bill to the tune of more than $1 billion a year. Most of the committee's alternatives are variants on a flat income tax, which would fall more equitably on people of differing incomes. Therefore, if the state creates an income tax, the report suggests lowering the sales tax or even lowering the property tax. Meanwhile, for businesses the committee recommends creating a new Canadian-style value-added tax or a corporate income tax, replacing the current business and occupation tax, which some industries say is unfair. Lawmakers, already facing a $2 billion budget hole next year, seemed dubious about the short-term prospects of major tax reform. "The income tax, we just don't see that happening," said

Sen. Dino Rossi, R-Sammamish, the incoming chairman of the Senate

Ways and Means Committee. "We have 2 billion of our own problems

right now." Even Democrats generally inclined to favor an income tax seemed uncertain what to do with the committee's proposal.

The committee recommends eliminating other taxes, for example, the

sales tax you pay on construction labor when "The voters, I think, are a little grumpy about taxes these days, and I think that makes this a great opportunity to ask them some questions about what their choices are," said Rep. McIntire. Supporters of a state income tax say one big advantage is that whatever you pay in a state income tax, you can deduct from your federal income tax if you itemize. That way, the federal government is essentially subsidizing our state taxes something we cant take advantage of right now. |

Bill

Gates, Sr., second from left, heads the committee

Bill

Gates, Sr., second from left, heads the committee  you build a house. All these are ideas to make our tax system more

fair, but will lawmakers dare to touch any of them?

you build a house. All these are ideas to make our tax system more

fair, but will lawmakers dare to touch any of them?