|

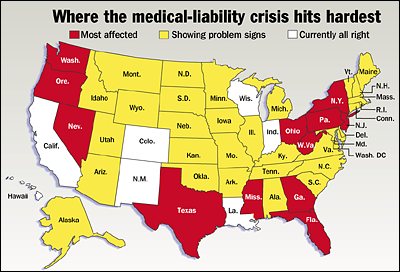

Liability costs drive doctors from

practice - Record insurance

premiums force shutdowns of health facilities from West Virginia

to Nevada.

LAS VEGAS – Shelby

Wilbourn, a doctor, left his office here last Thursday afternoon,

spent the evening packing his belongings, and then fled about as

far as he could from Nevada – to a town in coastal Maine. For

good.

Dr. Wilbourn, like at least a dozen other local obstetricians, has been turning pregnant women away for months. The reason: punishingly high insurance rates. He was facing a medical-malpractice premium of $108,000, up from $33,000 last year. In Maine, he'll pay $9,800. "If things don't work out in Maine, this is the last place I'd come back to," says Wilbourn, who has never been sued. Wilbourn's abrupt departure is symbolic of a growing revolt by thousands of doctors across the country. Beset by record premiums, they are opting to quit, move, or scale back their practices. The result is a budding healthcare crisis from West Virginia to Nevada. "It is a dire situation that is coming to a head now and needs to be resolved," says Carol Golin, editor of the Medical Liability Monitor, an insurance-industry watchdog newsletter. True, doctors have been complaining about malpractice rates as long as they have about bad tee times. But the issue is quickly taking on national significance as the number of affected physicians – many of them obstetricians, surgeons, and emergency-room staff – grows by the day. For example: • More than 80 percent of the orthopedic surgeons in Pennsylvania said in a recent poll that they are considering leaving the state to find cheaper insurance. • The maternity ward of tiny Bisbee, Ariz., which last year delivered about 275 babies, shut down completely earlier this year. • No neurosurgeons in Wheeling, W.Va., are practicing anymore, forcing many people with traumatic injuries to receive treatment out of state. • Fear of malpractice lawsuits has some insurance carriers urging their Mississippi doctors to stop giving free physicals to student athletes. Some free sessions have already been canceled. Behind the crisis is a decision by the nation's second-largest underwriter to stop selling malpractice insurance and the proclivity of Americans to sue doctors. "People think they can hit a jackpot in the liability lottery," says Donald Palmisano, president-elect of the American Medical Association (AMA). "All sorts of cases with no merit are being filed, and it costs money to defend against those cases." 12,000 doctors written off Citing $1 billion in losses last year because of more multimillion-dollar judgments and a flagging economy, the St. Paul Cos. announced in December it would stop writing malpractice insurance policies for the 12,000 physicians it covered. The decision sent doctors scurrying for other coverage, only to find that remaining companies demanded as much as a 300 percent hike in insurance premiums. For certain specialties that are more common targets of lawsuits – such as obstetrics – insurers wouldn't write policies at all. Las Vegas emerged as the national focal point for the problem on July 3, when the only trauma center in the area, which serves a 10,000-square-mile region, closed because several surgeons quit. The center reopened last weekend after enough doctors agreed that Clark County, which includes Las Vegas, would hire them, thus placing the doctors under a special $50,000 malpractice liability cap. "There are factors operating, particularly in Nevada, which make it a prime example of the problems physicians, hospitals, malpractice insurers, and patients are facing nationwide," says Ms. Golin. Nevada's legislature is expecting to convene a special session later this month to address limits on jury awards in malpractice lawsuits, as well as the statutes of limitations for such cases. Congress is considering similar measures, as are other state legislatures. Some states, however, already have strictures in place that were hammered out well before the current crisis. In California, for example, juries can't award more than $250,000 for pain and suffering. State law also caps the percentage that lawyers can take from the judgments and shortens the statutes of limitations to hasten the litigation process. The insurers still in the medical-malpractice field offer significantly lower rates to doctors in California, as well as in other states with similar legislation. "The symbol and standard was set by California," says Ikram Khan, who sits on a task force convened by Nevada Gov. Kenny Guinn to study solutions in advance of the special session. "Caps vary from state to state, but all the available studies show that they are effective in lowering premiums in the long run." It also may lower the cost of healthcare in general, according to a 1996 Stanford University study. The researchers found that hospitals spent 5 percent less on heart-disease patients in states with jury caps, yet saw no difference in health results. That led to the conclusion that a fear of being sued drove some doctors to order more tests and treatments than necessary to protect themselves from liability. The trial lawyers' defense Trial lawyers have thus far taken a public-relations beating, being pegged as greedy opportunists. But they're about to mount a defense, with lawyer groups like Citizens for Justice in Nevada planning to air TV commercials that urge the public to oppose jury caps. Their take: Insurance companies kept rates too low during the '90s in an attempt to be competitive, and now, as their investments lose value on the stock market, they're inflating premium prices. Trial lawyers also accuse doctors of scaring the public into giving away its ability to punish malpractice. "The insurance companies created the problem, they exacerbated the problem by writing policies for bad doctors, and then, when the consequences of their actions became known, they leave the market and the physicians holding the bag," says former Nevada Trial Lawyers Association president Bill Bradley, who insists there's no correlation between jury awards and malpractice insurance rates. "To place the blame on the civil-justice system is not fair or accurate. This is not a war between lawyers and physicians." But to many physicians, it is war indeed. The AMA is mounting a multimillion-dollar fund to "educate the public" about their position, and doctors in several states have staged protests. "It's completely weird for physicians to be doing

this," says Weldon Havins, CEO and special counsel for the

Clark County Medical Society in Nevada. "Doctors are

competing with lawyers who have, from their first day of law

school, been trained and are aware of the political process and

the importance of law. Doctors have absolutely zero training with

that. It's a baby racing with an Olympic athlete."

In accordance with Title 17 U.S.C. Section 107, any copyrighted work in this message is distributed under fair use without profit or payment for non-profit research and educational purposes only. [Ref. http://www.law.cornell.edu/uscode/17/107.shtml]

|

||||||||||||||||